infoTECH Feature

The Operators Strike Back: The Next Generation of App Stores (Part 3)

Today, I take the handset vendor’s perspective. At InnoPath, we call these the OEMs. More so than an operator, who may need to support multiple platforms to reach all market segments, the handset vendor must take a more focused approach. This is especially true for the second-tier smartphone vendors who don’t have the economies of scale. Note the use of the word ‘smartphone.’ It is important, since some of these OEMs may have very large feature phone footprints, but may be marginal players at present in the Open OS space.

Given that RIM, Apple, and for the moment, Palm are vertically integrated, what is the best OS bet for an HTC, Nokia, Samsung, LG, Sony-Ericsson, or one of the up-and-coming Chinese vendors such as ZTE and Huawei (News - Alert)?

The first imperative is to move off legacy, proprietary platforms. Although these support Web browsing, e-mail, and are many times referred to as integrated devices, the application developer community just isn’t there. This could be said for Nucleus, BREW, and OEM proprietary OSs. Samsung, LG, and Sony-Ericsson (News - Alert) are all known for devices in this category, though all three have announced their intent to migrate their product lines over the next few years.

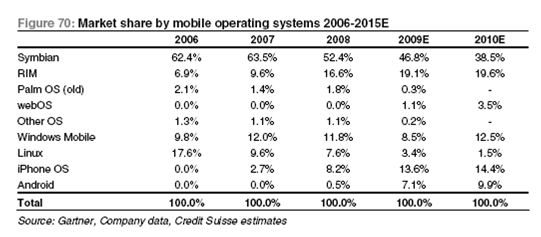

The next question is: Which of the Open OSs to support? We’ve got Windows Mobile, Symbian, Android, and flavors of Linux such as LiMo and Maemo. Reviewing current OS penetration on the chart below, Symbian, WM, and Android are all major players. In fact, at least one analyst, isuppli, takes a contrarian view to the prevailing wisdom and suggests that WM will take the Number 2 spot going forward on the strength of WM7 and vendor support. I’d personally also like to see WebOS be made available to other vendors, as an option to Android. I don’t think Palm can build critical mass on their own in the time they have.

Windows Mobile is a bit of an enigma in the marketplace, not only due to confusion regarding 6.5 and 7.0 strategy, but around whether or not Microsoft will deliver an integrated platform. A recent article in Fierce Wireless by Mike Dano added fuel to the fire in regard to what is to become of Windows Mobile in the face of handset vendor defection.

The flip side of the WM story are the rumored Pink devices which could very well be the way that Microsoft regains vertically integrated control of the OS and hardware, successfully demonstrated by Apple and more recently, Palm.

But beyond absolute market share, what is important is application availability, a good proxy for what handsets a consumer will actually go out and buy. This sets the stage for future success, since everyone can build a phone with GPS and a big touchscreen. We’re already seeing the shift in OS dominance, from the legacy to the new, and based on applications and internet use. Just this week AdMob issued its latest update, showing just how the tide has turned. The iPhone had taken the #1 share (40 percent) from Symbian (34 percent), and both Android and webOS had strong showings at 7 percent and 4 percent respectively. RIM was at 8 percent and WM at 4 percent.

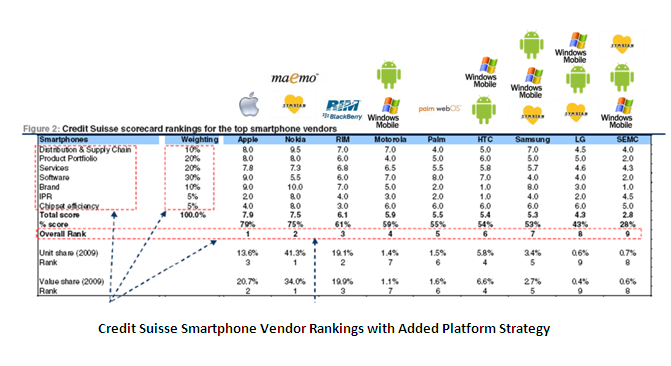

So, application availability should translate into a given OEM’s decision to support a platform (or not). Per the chart below, most vendors are fragmented in their Open OS support, even if they have only a few percent of the global smartphone market. Nokia, the largest, is probably the best positioned of the ‘independents’ due to its Symbian experience and up-and-coming Maemo support. The real issue with Nokia has been its inability to counter Apple, even in its home territory of Western Europe. Motorola (News - Alert) has taken a more focused course, placing most of its technical and marketing weight behind Android while continuing to support WM due to its strong enterprise footprint. This seems a reasonable approach and from all accounts, the CLIQ is a fine device. They’ve spent their time on matching the hardware to the OS. Unfortunately, this was not the case with HTC’s (News - Alert) first generation Android G1, and issue addressed with the Hero.

HTC, best known for Windows Mobile devices, is now doubling down with Android. They can’t walk away from their WM legacy, but if the Hero is any indicator, their Android devices will be successful. That leaves LG, Samsung, and Sony-Ericsson, all three at the bottom of the table below, and all three fragmented in their Open OS strategy at the same time they are transitioning from legacy OSs.

Sony-Ericsson has stated that they must support all three – Symbian, Android, and Windows Mobile – to hit different geographies and market segments. But are they large enough to support the engineering and support base? Samsung and LG, though larger, are still less of a factor in the Open OS space. Samsung and LG, BTW, are also members of LiMo, as evidenced by Vodafone’s (News - Alert) 360 announcement highlighting Samsung LiMO devices. The recommendation would be for all three vendors to take a strategic view of their market approach including tiers, geographies, and operator customers and then each prune at least one platform from their roadmap. All three have their own UI approaches. They could apply their engineering resources to perfecting this on one or two platforms, building a user experience that would begin to approach Apple.

As to the Chinese, I don’t see any reason for them to adopt anything other than Android, or in some cases, some other Linux variant. The logic when looking at application support, cost of development, and installed base just isn’t there. It permits them to better focus their development efforts and customer support, and by relying on an easily adaptable OS foundation they will be better able to apply their efforts towards differentiation (i.e., at the UI level as HTC has done with Sense on Android or TouchFlo3D on Windows Mobile) vs OS maintenance and other forms of reinventing the wheel.

David Ginsburg is vide president of marketing at Innopath Software.

Edited by Michael Dinan

infoTECH Headlines

What Is AWS EFS? Features, Use Cases, and Critical Best Practices

Cost-Effective Approaches to s1000d Conversion

A virtual crossroads for technology enthusiasts

Benefits of employee monitoring software in preventing overworking of workers

CI/CD: Trends and Predictions for 2024

Technical Documentation for IT: A Practical Guide

Managing Your Costs on AWS: A 2024 Guide

What Is Application Dependency Mapping?

Top 5 Kubernetes Errors and How to Solve Them

How Artificial Intelligence Can Improve the World of Online Gaming Platforms

Rich Tehrani

Rich Tehrani

By

By