infoTECH Feature

VAT Introduction is the Case for e-invoicing & e-archiving

Practically speaking, how can e-invoicing solutions assist GCC businesses in the VAT implementation?

One of the primary implications of VAT implementation for all businesses charging VAT on supplies is the necessity to issue VAT invoices as an evidence of a sales transaction. Of course, businesses can issue VAT invoices in paper, however, paper-based invoicing poses several challenges both to a selling and a buying party, including: accounting codification, invoice validation, typing errors, disputes between trading partners arising from overpayment, underpayment, incorrect data. Switching from paper invoices in favor of electronic invoices can resolve these issues by introducing full automation and transparency in terms of invoice circulation between sellers/buyers and tax authorities.

Charging VAT on supplies

In the VAT landscape, GCC businesses will be obliged to charge VAT on supplies at a correct rate – either a standard rate (5 percent) or a zero rate. This extra administrative burden will be particularly time-consuming and error-prone to trading companies with a big volume of invoices on a regular basis. However, e-invoicing solutions can facilitate this process by automatically matching a correct VAT rate to a given product.

Calculating VAT deductible

Following the introduction of VAT, companies across the GCC will be required to calculate VAT deductibles on purchases. Electronic invoicing can also come in handy in this area. Instead of calculating VAT deductibles manually, companies can make use of the VAT mechanism embedded in the e-invoice suite which automatically calculates the correct amount.

Calculating the total net amount of VAT to pay / to refund

Another requirement of VAT relies on calculating the total net amount of VAT to pay or to refund. Of course, businesses can calculate the amounts of VAT manually, without any enterprise software, but electronic invoicing can be an answer to this challenge as well. Simply because e-invoice suite uses accurate validation mechanisms, you can be sure that the net amount is correct and a document can be quickly processed further.

Cash Flow

The implementation of VAT means that improved cash flow will become even more important than before. Settling bills and collecting payments fast is directly linked to the working capital of a company.

With an e-invoicing solution, cash flow management can be significantly accelerated because both a seller and a buyer can instantly check on the payment status or verify the invoice status (to pay, paid, overdue, etc.) in the system. Better cash flow visibility allows users to manage accounts payable and accounts receivable optimally.

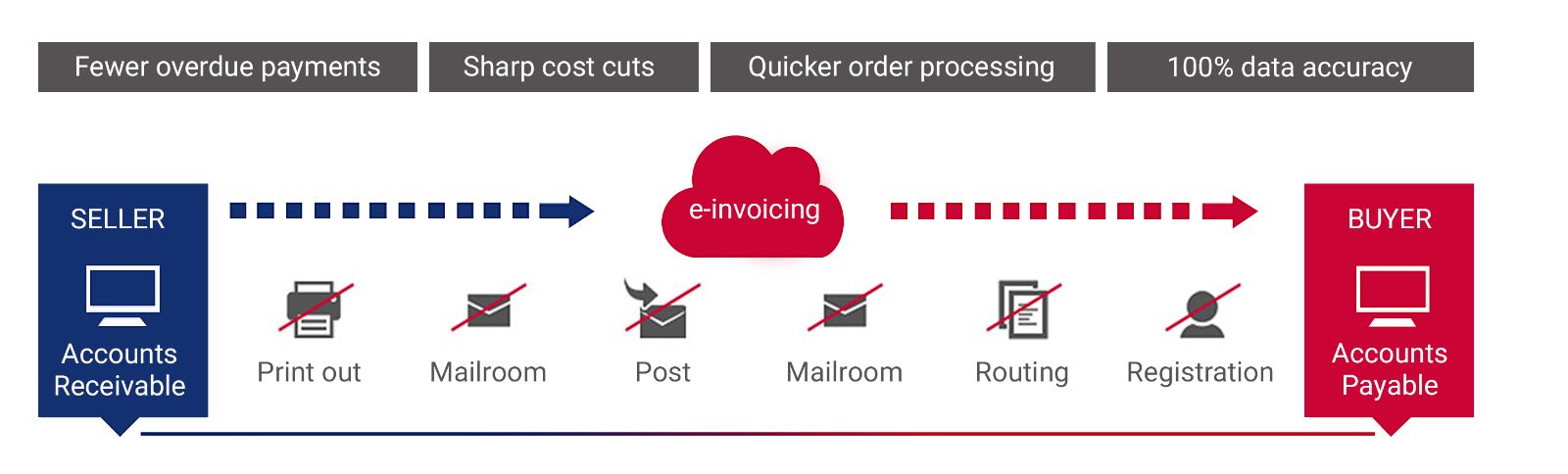

Consequently, businesses using electronic invoicing by far improve the timing of VAT recovery on costs. Putting VAT considerations aside for a moment, to understand the full potential of e-invoicing, it is important to realize just how time-consuming and costly paper-based invoice management is. To process each paper invoice, both sellers and buyers must perform a number of activities which become redundant upon adopting e-invoicing, including document printing, mailroom services, and postal services among others.

What impact will VAT introduction have on document archiving and how can electronic archiving facilitate this process?

Starting from 2018, all businesses implementing VAT will be required to keep a record of transaction documents i.e. invoices, records, accounts, VAT returns, etc. Storing paper documents comes with additional administrative burden and extra cost incurred e.g. for space rental. Against this background, focusing on electronic archiving appears to be a reasonable move. Why? With electronic archiving, businesses can have convenient access to all transaction documents for any tax audit and easily comply with the legal requirements.

It is crucial for electronic archiving solutions to guarantee proper security measures. I can risk saying that documents kept in the electronic archive are safer than paper documents in the traditional archive. To achieve proper data security, I would recommend opting for e-archive solutions that incorporate time stamping and access control. Time stamp confirms that a given document has not been changed since its creation day as well as guarantees a correct issuer. For access control, an entrepreneur can grant access to the archive only to selected users and is always in the know about when it was viewed or edited and by whom. Also, in the event of a tax audit, it is possible to grant temporary access to the audit authority, both to a printable document and an original file of this document. In the light of the binding law on electronic transactions in the UAE, for example, both time stamping and access control meet the legal requirements stated in the Federal Law No. (1) of 2006 On Electronic Commerce and Transactions.

Name the most important issues to discuss with an IT provider in the light of VAT implementation in the GCC

Now is the right time for GCC businesses to assess technological capabilities of existing IT solutions and implement new enterprise software to get ready for VAT implementation.

When it comes to the e-invoicing technology, GCC companies should look for e-invoice providers offering a wide spectrum of e-invoicing technologies legally compliant with the new VAT regulations.

These days, the most widespread technological solutions include:

EDI Invoice Suite (Electronic Data Interchange),

PKI Invoice Suite (Public Key Infrastructure).

The selection of e-invoicing technology is conditioned by the volume of invoices handled by a given trading company. EDI invoicing is recommended to companies with a large volume of invoices (both issuers and recipients), while PKI invoicing is suitable for companies with a big total number of invoice recipients but rather a small volume of invoices per a single recipient.

Software integration is another crucial matter. System integration with accounting solutions or ERP is essential to achieve 100 percent automation, when no manual workload is required. By establishing cooperation with an IT provider who can deliver built-in integration engines, invoices are captured from and delivered to the financial system in the fully automated manner.

In order to increase the data accuracy, it is important to opt for solutions with a multi-level validation engine, where all electronic invoices are validated in terms of: size, e-signature, master data, content, EAN code among others.

Certain lead time is needed to technologically prepare for VAT introduction, yet properly planned and conducted VAT implementation will result in full VAT compliance as well as business process automation achieved, owing to enterprise solutions such as e-invoicing suite or e-archiving suite.

About the Author

Lukasz Spirala is the Business Development Manager at Infinite IT Solutions. He is responsible for implementations of enterprise solutions at trading companies of various industries across the GCC region and is a member of the Middle East Council of Shopping Centres (MECSC).

infoTECH Headlines

What Is AWS EFS? Features, Use Cases, and Critical Best Practices

Cost-Effective Approaches to s1000d Conversion

A virtual crossroads for technology enthusiasts

Benefits of employee monitoring software in preventing overworking of workers

CI/CD: Trends and Predictions for 2024

Technical Documentation for IT: A Practical Guide

Managing Your Costs on AWS: A 2024 Guide

What Is Application Dependency Mapping?

Top 5 Kubernetes Errors and How to Solve Them

How Artificial Intelligence Can Improve the World of Online Gaming Platforms

Rich Tehrani

Rich Tehrani

By

By