infoTECH Feature

Big Data Drives Storage Revenue

By Gary Kim

By Gary KimRevenue from storage consumed by big data users will increase from $379.9 million in 2011 to nearly $6 billion in 2016, according to Ashish Nadkarni, International Data Corporation research director.

The Storage for Big Data report predicts that storage demand will grow at a compound annual growth rate (CAGR) of 53 percent between 2011 and 2016, IDC says.

In early 2012, the “big data” market represented just over $5 billion based on related software, hardware, and services revenue.

According to Wikibon, big data revenues will grow to about $53 billion by 2016.

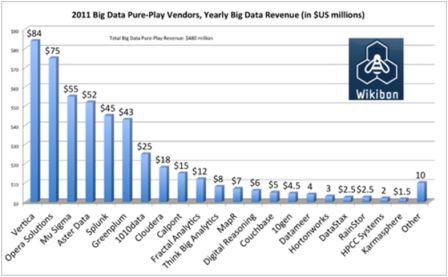

Big data pure-play vendors that earn at least half of total revenue accounted for about $480 million in revenue in 2011, Wikibon said.

Source: Wikibon 2012

In 2011, big data market leaders, by revenue, were IBM (News ![]() - Alert), Intel, and HP.

- Alert), Intel, and HP.

Big Data revenue by Supplier

|

Vendor |

Big Data Revenue (in $US millions) |

Total Revenue (in $US millions) |

Big Data Revenue as Percentage of Total Revenue |

|

IBM |

$953 |

$106,000 |

1% |

|

Intel |

$765 |

$54,000 |

1% |

|

HP |

$513 |

$126,000 |

0% |

|

Fujitsu |

$285 |

$50,700 |

1% |

|

Accenture |

$273 |

$21,900 |

0% |

|

CSC |

$160 |

$16,200 |

1% |

|

$154 |

$61,000 |

0% |

|

|

Seagate |

$149 |

$11,600 |

1% |

|

$138 |

$19,000 |

1% |

|

|

$120 |

$2,200 |

5% |

|

|

Amazon Web Services |

$116 |

$650 |

18% |

|

SAS Institute |

$115 |

$2,700 |

1% |

|

Capgemini |

$111 |

$12,100 |

1% |

|

Hitachi |

$110 |

$100,000 |

0% |

|

SAP |

$85 |

$17,000 |

0% |

|

Opera Solutions |

$76 |

$100 |

76% |

|

NetApp |

$75 |

$5,000 |

0% |

|

Atos S.A. |

$75 |

$7,400 |

1% |

|

Huawei |

$73 |

$21,800 |

0% |

|

$69 |

$102,000 |

0% |

|

|

Xerox |

$67 |

$6,700 |

1% |

|

Tata Consultancy Services |

$61 |

$6,300 |

1% |

|

SGI |

$60 |

$690 |

9% |

|

Logica |

$60 |

$6000 |

1% |

|

Mu Sigma |

$55 |

$65 |

85% |

|

Microsoft |

$50 |

$70,000 |

0% |

|

Oracle |

$50 |

$36,000 |

0% |

|

Splunk |

$45 |

$63 |

68% |

|

1010data |

$25 |

$30 |

83% |

|

Supermicro |

$23 |

$943 |

2% |

|

MarkLogic |

$20 |

$80 |

25% |

|

Cloudera |

$18 |

$18 |

100% |

|

Red Hat |

$18 |

$1,100 |

2% |

|

Informatica |

$17 |

$750 |

2% |

|

Calpont |

$15 |

$25 |

60% |

|

ClickFox |

$11 |

$35 |

31% |

|

Fractal Analytics |

$12 |

$12 |

100% |

|

Pervasive Software |

$10 |

$50 |

20% |

|

Tableau Software |

$10 |

$72 |

14% |

|

Think Big Analytics |

$8 |

$8 |

100% |

|

MapR |

$7 |

$7 |

100% |

|

Digital Reasoning |

$6 |

$6 |

100% |

|

ParAccel |

$5 |

$11 |

45% |

|

Couchbase |

$5 |

$6 |

84% |

|

DataStax |

$4.5 |

$4.5 |

100% |

|

10gen |

$4.5 |

$4.5 |

100% |

|

Datameer |

$4 |

$4 |

100% |

|

Hortonworks |

$3 |

$3 |

100% |

|

RainStor |

$2.5 |

$2.5 |

100% |

|

Attivio |

$2.5 |

$19 |

13% |

|

QlikTech |

$2 |

$300 |

1% |

|

HPCC Systems |

$2 |

$2 |

100% |

|

Karmasphere |

$2 |

$2 |

100% |

|

Other |

$25 |

n/a |

n/a% |

|

Total |

$5,125 |

$866,671 |

1% |

The growth will come largely from capacity-optimized systems (including dense enclosures), the IDC report says.

Performance was cited as the primary driver for selecting storage architecture for 68.6 percent of respondents. Another 59.5 percent indicated cost also was a primary driver.

Just under 31 percent of respondents said they had no deployment of enterprise storage systems for data analytics infrastructure, but plan to start deploying in the next six months.

The type of converged infrastructure deployed for big data infrastructure was split almost evenly between discrete converged infrastructure (30.1 percent), compustorage (29.4 percent), and in-house approaches (28.4 percent).

Analysis of operations-related data was cited by 63.7 percent of respondents as the primary use case for deploying data analytics infrastructure. Analysis of transactional data from sales or point-of-sale systems was cited by 53.3 percent of respondents.

IT was by far the greatest influencer of data analytics infrastructure. Operations was a distant second.

Improving customer satisfaction is the greatest business challenge to be solved with data analytics deployments, according to just over 61 percent of respondents.

Edited by Rich Steeves

infoTECH Headlines

What Is AWS EFS? Features, Use Cases, and Critical Best Practices

Cost-Effective Approaches to s1000d Conversion

A virtual crossroads for technology enthusiasts

Benefits of employee monitoring software in preventing overworking of workers

CI/CD: Trends and Predictions for 2024

Technical Documentation for IT: A Practical Guide

Managing Your Costs on AWS: A 2024 Guide

What Is Application Dependency Mapping?

Top 5 Kubernetes Errors and How to Solve Them

How Artificial Intelligence Can Improve the World of Online Gaming Platforms

Rich Tehrani

Rich Tehrani